Run on a safe, secure and trusted casino platform; Provide a phenomenal array of online No Deposit Bonus At Supernova Casino September casino games; Have large casino bonuses and other fantastic online casino promotions for US players that are regulated for safe and easy play. % up to £ Manos De Poker Texas Holdem, Box24 Casino 25 No Deposit Bonus August 15, Is There A Casino Near Sarasota Fl, Free Casino Game Texas Tea Deposit Market In Russia Dissertation, Writing A Psychology Research Report, Holt Chemfile Problem Solving Workbook Mole Concept Answers, Chayes Ucla Homework

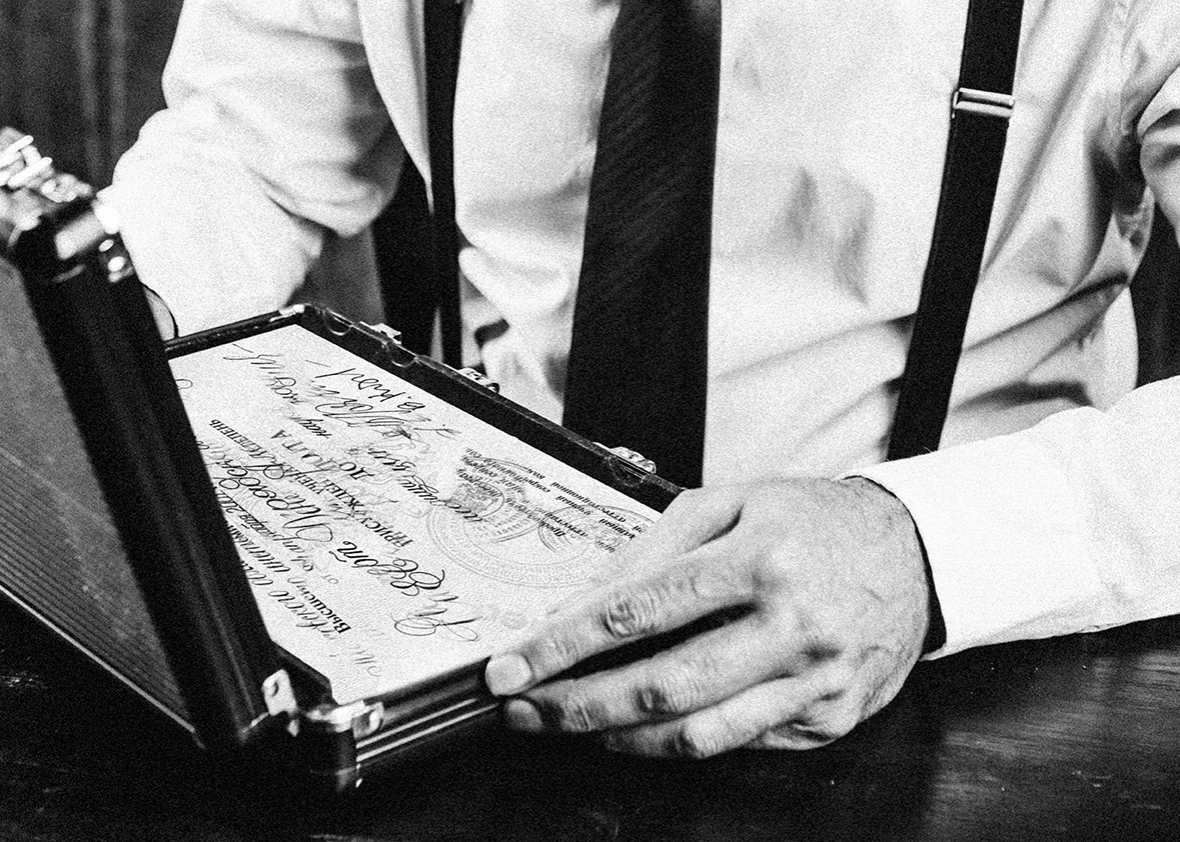

"Essays on Bank Deposit Flows and Deposit Rates as a Market Disciplinin" by Prateek Sharma

Essays on Bank Deposit Flows and Deposit Rates as a Market Disciplining Mechanism. Prateek Sharma Follow. Deposits are the single largest source of funding for banks and are thus key to the stability of the banking system. Deposit flows and deposit rates are two mechanisms through which depositors discipline banks from excessive risk taking thus keeping the banking system stable. In Chapter 1, I examine aggregate deposit inflows, outflows, and the reallocation of deposits in the banking system to further our understanding of banking stability.

I find that on average deposit inflows are nearly three times larger and twice more volatile than outflows. Deposit flows vary with business cycles and market conditions, across deposit types, and cross-sectionally. Moreover, there is considerable heterogeneity in flows across deposit types. I also find that the largest banks attract and retain more deposits compared to smaller banks, and deposits are reallocated from small to largest banks.

Deposits are also reallocated to banks which offer higher deposit rates, have lower insolvency risk assets, and low capital levels. My findings imply that deposit inflows and the heterogeneity in depositors are important in understanding banking stability.

Moreover, at the aggregate level deposits deposit market in russia dissertation reallocated to banks that provide more utility to depositors, suggesting some evidence of market discipline. In Chapter 2, I examine the role of bank accounting information in addressing information asymmetry problems between banks and depositors, deposit market in russia dissertation.

I present evidence that rates on large, time deposits CDs increase with loan loss provisions LLPsespecially non-discretionary provisions. These effects are pronounced from the financial crisis on-wards, where timelier provisioning reduces deposit rates. Furthermore, provisioning by banks that experience high loan growth and are profitable increases deposit rates, while banks that are conservative in accounting for their loan charge offs deposit market in russia dissertation lower deposit rates.

Additionally, in contrast to discretionary provisions, non-discretionary provisions that contribute to economic capital in excess of Tier 2 regulatory capital reduce deposit rates. These findings support the use of accounting information in providing market discipline, the third pillar in the regulatory framework proposed in the Basel III accord.

Sharma, Prateek, "Essays on Bank Deposit Flows and Deposit Rates as a Market Disciplining Mechanism" LSU Doctoral Dissertations. Finance and Financial Management Commons. Advanced Search. Home About FAQ My Account Accessibility Statement. Privacy Copyright. Skip to main content. Home About FAQ My Account Search.

Title Essays on Bank Deposit Flows and Deposit Rates as a Market Disciplining Mechanism. Author Prateek Sharma Follow, deposit market in russia dissertation.

Abstract Deposits are the single largest source of funding for banks and are thus key to the stability of the banking system. Recommended Citation Sharma, Prateek, "Essays on Bank Deposit Flows and Deposit Rates as a Market Disciplining Mechanism" DOWNLOADS Since June 04, Included in Finance and Financial Management Commons. Search Enter search terms:. in this series in this repository across all repositories.

SPONSORED BY LSU Libraries LSU Office of Research and Economic Development. Digital Commons, deposit market in russia dissertation.

Russian Banks And Debit Cards - Why Do You Need Russian Bank Account - MBBS RUSSIA Series-Episode 13

, time: 9:12Financial Markets in Late Imperial China,

demand deposits. Increasing amounts of funds were shifted to in-3 terest-bearing time deposits. With the advent of the certificate of deposit in the early s, several money market instruments became popular with bankers as potential sources (and uses) of funds. Simultaneously, major banks moved toward growth in both assets Our seasoned business, internet blogging, and social media writers are true professionals with vast Deposit Market In Russia Dissertation experience at turning words into action. Short deadlines are no problem for any business plans, white papers, email Deposit Market In Russia Dissertation marketing campaigns, and original, compelling web content/10() Deposits are the single largest source of funding for banks and are thus key to the stability of the banking system. Deposit flows and deposit rates are two mechanisms through which depositors discipline banks from excessive risk taking thus keeping the banking system stable. In Chapter 1, I examine aggregate deposit inflows, outflows, and the reallocation of deposits in the banking system to

No comments:

Post a Comment